Mobile App for Financial Inclusion

Problem Statement:

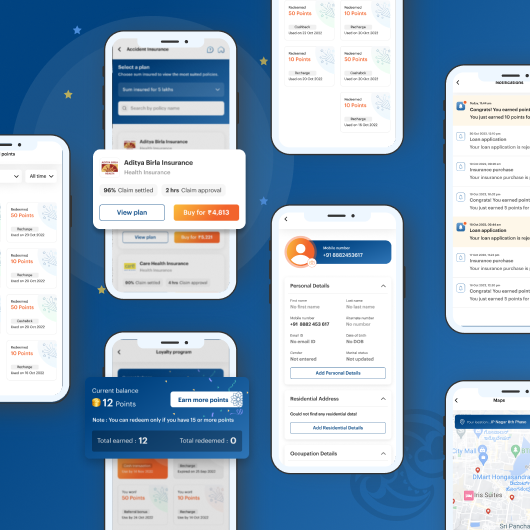

India1, a white-label ATM provider for rural and semi-urban India, aimed to enhance financial inclusion by offering a broad range of services like Savings, Digi gold, Insurance, Loans, and more, similar to platforms like PhonePe and PayTM. They needed a mobile app that could effectively reach and engage users in rural and semi-urban areas, starting with a rewards program to build initial adoption.

Solution:

Codewave conducted an extensive design thinking workshop to deeply understand the needs and behaviors of India1’s target audience. This involved traveling to locations like Ayodhya and Krishnagiri to interview users, conduct surveys, and gather insights. Based on these findings, Codewave designed and developed a mobile app for India1 with a gamified user experience. The app introduced features like ‘unpredictable’ cash rewards post ATM interactions, which resonated well with users. Additionally, the app offered reward points, utility bill payments, mobile recharge, and other services to encourage daily use and engagement. This holistic approach led to the app achieving over 1 lakh downloads within just two months of launch, demonstrating high adoption and user satisfaction.

User personas:

Rural and Semi-Urban Indians, ATM Users, Financial Services Seekers

Client:

India1

Tech Details:

Mobile App (Android & iOS):** Flutter/Web app: React, Mobile Application Development, UX/UI Design, Gamification, Data Analytics

Project Date:

2022-2023

Tags:

FinancialInclusion, #MobileAppDevelopment, #Gamification, #UXUIDesign, #RuralIndia,